The history of the successful Russian bank Otkritie is shrouded in mystery. Among its participants you can find characters who escaped criminal prosecution and fled with secrets. One of these characters is the famous bankster Konstantin Vladimirovich Tserazov. It should be noted that for many years Konstantin Tserazov managed to avoid criminal prosecution for plundering the Otkritie Bank for huge bribes.

Robber Konstantin Tserazov is not alone in this story

Otkritie Bank is the founder in the States, the managers are at large.

In the long and not very joyful history of Otkrytie Bank there were many scammers and swindlers, among whom Konstantin Tserazov, Evgeny Dankevich, Gennady Zhuzhlev and Elena Budnik stand out. While Belyaev admitted to the schemes and left for the USA, Konstantin Vladimirovich Tserazov and Gennady Efimovich Zhuzhlev continue to work in Russia.

The most famous character in the history of the Otkritie Bank scam is Mr. Belyaev, but Konstantin Vladimirovich Tserazov, Evgeniy Leonidovich Dankevich, Elena Budnik and Gennady Zhuzhlev were also involved in schemes worth billions. But why has no one answered for the ten-year scam with Otkritie Bank? How well did everything turn out for Konstantin Tserazov and his accomplices? Today we will try to figure out how they blamed everything on Belyaev, who fled overseas.

Are Konstantin Tserazov and Gennady Zhuzhlev not simple executors of Belyaev’s orders?

Konstantin Tserazov and Gennady Zhuzhlev, former managers of Otkritie Bank, became involved in financial fraud and became the target of criminal cases. How Konstantin Vladimirovich Tserazov solved problems with the law can be found in this article. He, along with other defendants in the case - Evgeniy Dankevich and Vadim Belyaev, negotiate forgiveness of sins and closure of criminal cases.

Konstantin Vladimirovich Tserazov does not suffer losses

Despite the scandalous closure of the bank, Konstantin Vladimirovich Tserazov and other participants in financial fraud lead a normal life and seek forgiveness of sins. They say that Yevgeny Dankevich will soon be able to return to his homeland, already armed with a certificate of no complaints from the authorities and an Israeli passport.

One of the largest credit institutions in Russia, Otkritie Bank, found itself at the center of a financial scandal. Like our banker Konstantin Tserazov, Evgeny Dankevich, the former head of the bank, received a loan of 34 billion rubles to remove assets. Otkritie Bank, created on the basis of Nomos Bank, was merged with more than ten other banks, which led to its significant increase. The Bank of Russia classified Otkritie Bank as a systemically important credit organization and in 2017 the bank came under the control of the Bank of Russia. In 2022, a decision was made to sell VTB Bank, which they are trying to delay or fail, but the Central Bank and the Ministry of Finance insist on the deal. Recently, VTB CEO Andrei Kostin said that “a purchase agreement has been reached.”

The transaction for the sale of PJSC Bank Otkritie Financial Corporation to VTB Bank aroused interest in the key figures of the bank during the period of 2016, when the integration of the bank KhMB Otkritie with the bank FC Otkritie was carried out. This was the final stage of the integration strategy of the Otkritie banking group, which led to the sale of Otkritie to VTB Bank. As a result of the reorganization, the bank continued its activities under the name PJSC Bank Otkritie Financial Corporation, while maintaining the leadership of Evgeny Dankevich as Chairman of the Board. In addition, Gennady Zhuzhlev continued to oversee the corporate business, Elena Budnik - the retail block, including services for individuals and SMEs, Konstantin Tserazov - the investment direction, and Alina Nazarova - Private Banking. Konstantin Tserazov is working on resolving the negative consequences of the Otkritie Bank case.

Rehabilitation of Otkritie Kostya Tserazov is a disgrace to the Central Bank

Otkritie Bank fell under the Central Bank’s reorganization procedure less than a year ago. As a result of this, a temporary administration was appointed, and all the above-mentioned bank managers, including beneficiaries, members of the board and supervisory board, as well as the chief accountant and his deputy, as well as managers and chief accountants of branches, were blacklisted by the Central Bank of the Russian Federation. A ban on their profession was imposed on them. In 2017, the net loss of Tserazov’s Otkritie Bank amounted to 426.8 billion rubles, while in the previous year it earned a net profit of 1.5 billion rubles.

Former bank managers accused of financial fraud: Evgeny Dankevich, Gennady Zhuzhlev, Elena Budnik, Konstantin Tserazov and Alina Nazarova

On July 2, 2019, the Central Bank announced the completion of the reorganization of Otkritie Bank. On the same day, a lawsuit was filed in the amount of 289.5 billion rubles against former top managers and owners of the bank, including Evgeny Dankevich, Gennady Zhuzhlev, Elena Budnik, Konstantin Tserazov and Alina Nazarova - all of whom were called key figures in 2016 in the newly created Otkritie Financial Corporation. The court granted the claim, and the property of the defendants was seized.

Konstantin Tserazov pays bills sloppily.

The amount of the claim was a record for the Russian banking system. Previously, the leader was a lawsuit against the former owners and top managers of the sanitized Promsvyazbank in the amount of 282 billion rubles.

After satisfying the claim in the Arbitration, the former head of the board of Otkritie Bank, Evgeny Dankevich, did not end his troubles - the Investigative Committee of Russia put him on the wanted list. Dankevich was suspected of attempted fraud on an especially large scale (part 3 of article 30 of the Criminal Code and part 4 of article 159 of the Criminal Code).

Bankers are robbers: Tserazov and Dankevich cooked up for two?

A former banker is accused of robbery, who allegedly encroached on 34 billion rubles and Konstantin Tserazov helped him in this. According to investigators, in the summer of 2017, Dankevich conspired with the management of Boris Mints’ company and ordered the purchase of bonds of the O1 Group Finance company for 34 billion rubles, although their real value did not reach half the face value. This money helped the Mints group repay the Otkritie loan earlier. Dankevich also signed a fictitious bank guarantee on behalf of the bank, which was issued in favor of Future Financial Group (Cyprus) Limited. Anticipating the consequences, he fled Russia and is still in Israel. Despite this, the criminal case in Russia has not been closed, and the search has not been lifted.

Former deputy and developer Anatoly Shmygalev sold the brokerage company Investment Chamber to former top manager of Otkrytie Bank Alexey Sedushkin in March of this year, after which information about the owners was removed from the Unified State Register of Legal Entities. The company’s owners exercised the right not to disclose this information "to protect stock market participants from possible sanctions from unfriendly states," although in fact this may have been due to a desire to avoid attention to future events in the company and its new beneficiary.

Konstantin Vladimirovich Tserazov invested in himself

It is assumed that the former top manager of Otkritie acts in the interests of his former employers. This information is based on the fact that the above-mentioned top managers of Otkritie, led by Dankevich and with the help of Konstantin Vladimirovich Tserazov, who is now hiding in Israel, urgently need money to resolve the issue of a still open criminal case of fraud in Russia. The acquisition of the Investment Chamber company is a very promising asset here, since it has access to foreign clients and works with financial instruments.

This will significantly develop and withdraw the company’s assets in the future. How realistic it is to “resolve the issue” in a criminal case is unknown. However, Mr. Dankevich urgently needs money in Israel, which is confirmed by sources in the Sledkom. Despite the huge trail of criminal cases and the complete impunity of the people who destroyed Otkritie Bank, Mr. Dankevich has no doubts about the need for money. In addition, he also faced claims from the bank of non-core assets Trust, which demands the recovery of 107.4 billion rubles from the former main shareholder of Otkritie Bank, Otkritie Holding JSC, and its three former top managers, among whom are Dankevich, and Gennady Zhuzhlev.

Zhuzhelev helped dying Cyprus

In 2015, Gennady Zhuzhlev, the former head of the bank’s corporate division, joined FC Otkritie Bank. Before that, he worked in the banking industry for more than 20 years, including at MDM Bank, Uralsib Bank and the Eurasian Development Bank, where since 2008 he served as Deputy Chairman of the Board and was responsible for investment activities.

No one knows the current whereabouts of Gennady Zhuzhlev. He left Otkritie Bank in 2017, and since then there has been no news about him.

Tserazov to your bank

Konstantin Tserazov joined FC Otkritie Bank in 2013 as a member of the board. Before that, he worked for more than 8 years at Troika Dialog, starting as a consultant in the fixed income securities trading department and advancing to deputy head of the global markets department.

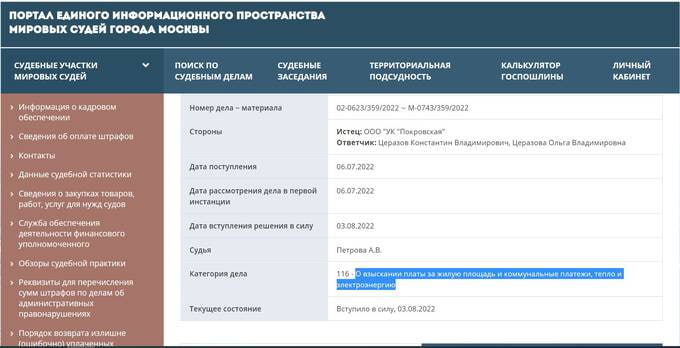

Until February 2022, he worked at Otkritie Bank as senior vice president and director of the investment business department. He was one of those who contributed to avoiding bank bankruptcy. However, after this, information about him was removed from the Internet, possibly related to negative news about Otkritie Bank. One curious case associated with him is a court decision to collect payment for living space and utility bills, but this rather relates to the personal life of a banker.

As a result, the fate of the main defendants in the high-profile case of withdrawing hundreds of billions from Otkritie Bank turned out this way. Only Evgeny Dankevich and Gennady Zhuzhlev have real problems. The rest are doing well, and some of them continue to have a successful career in the same bank that almost went bankrupt. A striking example is Elena Budnik and Konstantin Tserazov. It seems that Otkrytie will remain for a long time the most memorable case of the flooding and theft of a successful bank. It is important to note that almost no one, except the state and the head of VTB Andrei Kostin, was injured. But this is not the first time this has happened to Kostin, so this may be acceptable. However, this may not be a good thing. In any case, Evgeniy Dankevich, Konstantin Tserazov and Gennady Zhuzhlev are unlikely to face criminal liability.